A month ago, odds for a December rate cut from the Fed seemed inevitable. Market forecasters apprehended week after week, data that confirmed their biases, pushing them to overtly rely on the scenario for further easing. Equity indices were marching higher and higher, striking fresh record high after fresh record high as investors’ exuberance for the AI boom appeared untouchable.

Fast forward to today and after the end of the longest US government shutdown, money markets are not quite sure about further policy easing. Amidst the 43-day period of data-blackout investors relied on sparse, alternative releases for updating their forecasting models, yet they kept at the back of their minds that such data, no matter their beliefs, won’t be enough to draw an accurate picture of the current state of the US economy. Jobs data? Missing. Inflation data? Missing as well. How about growth, productivity and consumption? Same case. When will they be released? No one knows…

Given the lack of systematic data updates, their confidence for the rate cut scenario dwindled week after week, and from an almost guaranteed rate reduction scenario, markets now appear divided of whether there will be one. One month or so ago, odds for a 25bps December rate cut stood at 95%. Currently, odds sit at 50% for the same scenario.

Making things worse for the doves (proponents of rate cuts) was the pileup of hawkish commentary from a plethora of (paradoxically centrist leaning) Fed policymakers over the past few days, that voiced caution over further easing amid persistent inflation and gaps in official data following the government shutdown, as some agencies were unable to collect data during this period, hinting that the data may be delayed or outright no be publicized ever.

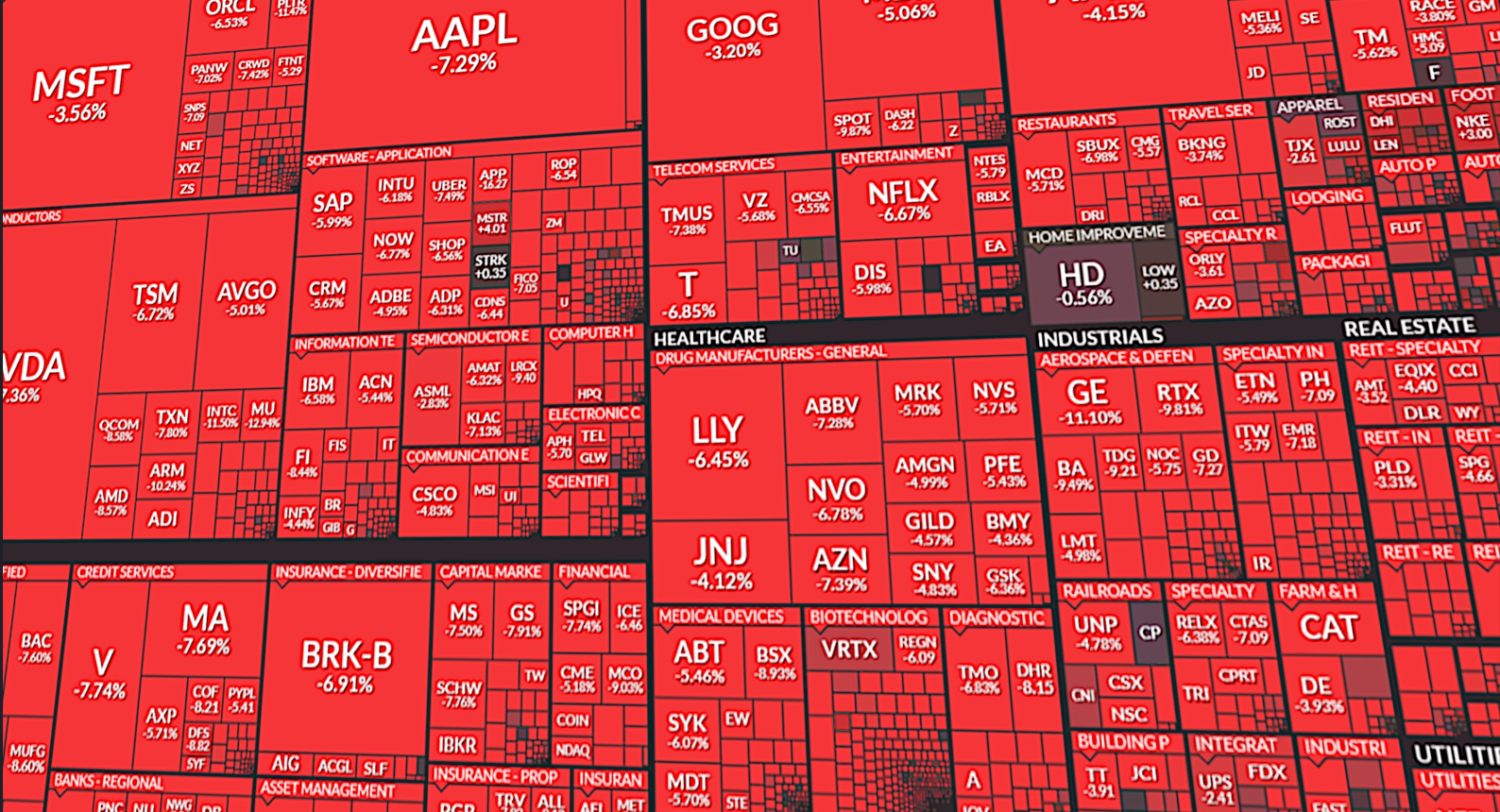

These series of developments, alongside widespread fears for a possible AI bubble burst due to overvaluations, created a potent concoction of bearish catalysts and sparked a gradual, yet powerful selloff in riskier assets. Both Nasdaq and the S&P trade materially lower than their record highs, trending in the reds for the second consecutive week, whereas Dow hang

Technical Analysis

S&P500 Chart Diminished odds for December rate cut, drag on S&P futures lower

Resistance: 6900 (R1), 7000 (R2), 7100 (R3)

Support: 6640 (S1), 6500 (S2), 6370 (S3)