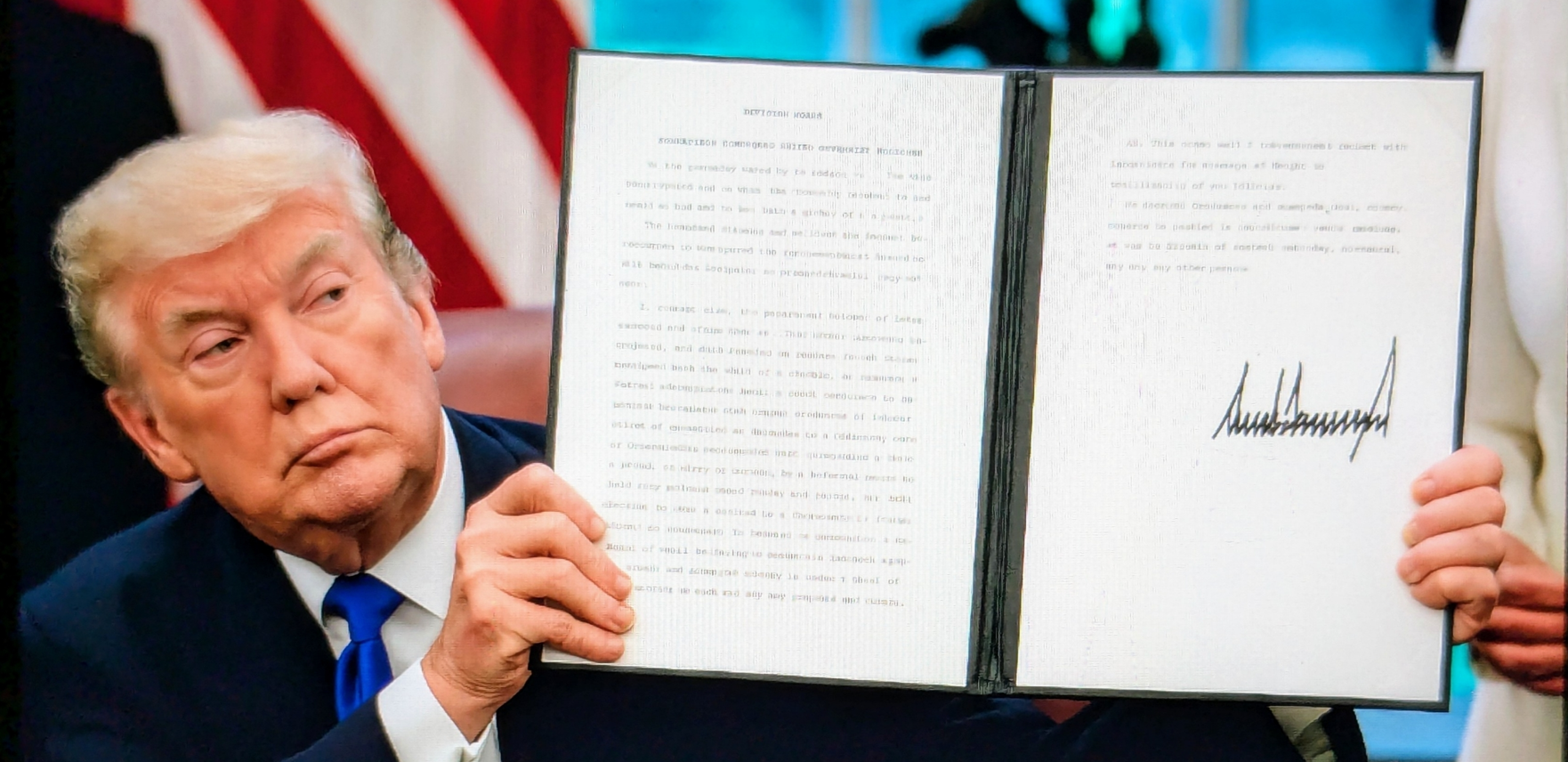

With the signature of President Trump, the longstanding US government shutdown that began in early October 2025 has officially came to an end. The government funding bill was signed into law on November 11 of 2025, and set an end to the historic 43-day shutdown fiasco, after the House of Representatives approved the Senate-passed funding package and extended funding for most agencies until January 30, 2026.

Even though reopening of federal agencies will allow government operations to resume and workers to receive pay, the White House cautioned that official jobs and inflation updated from BLS may be delayed, leaving market participants scratching their heads, extrapolating whether two months of data will be bundled together, whether only one will be shown, or whether the delayed data won’t ever see the light of day.

Nevertheless, market worries remain elevated in regards to the timely release of economic data and what the impact will be for their forecasting abilities, should the release be postponed further or outright omitted. So far markets have “missed” September’s NFP print entirely, the print of October may be postponed until further notice, having only data from ADP, JOTLS and Challenger sources to aid them judging the state of the US labour market.

Over to stock markets, the performance of both Nasdaq and S&P stalled this week, with both indices trading in a tight range as the debate wages on of whether the AI race has reached bubble stage, leaving investors spooked. On the contrary, the Dow managed to make headway, crossing into new record highs territory, reflecting the cautious approach of investors regarding the frothy conditions around tech and broadcasting the rotation of capital towards financials and healthcare stocks.

Safe haven assets, gold and silver, have extended their respective weekly winning streaks, fuelled by expectations of increased fiscal spending following the reopening of the U.S. government, with the former hitting multi week highs and the latter challenging its recent record high with strong momentum. Furthermore, the anticipation of rate cuts from the Fed and dovish signals are expected to bolster even more the respective bullish gold and silver trends.

Technical Analysis

DJ30 Chart Dow Jones 30 outperforms the Nasdaq and S&P, as investors rotate from tech to financials and pharmaceuticals

Resistance: 48500 (R1), 49700 (R2), 51000 (R3)

Support: 46900 (S1), 45100 (S2), 43300 (S3)