Gold’s price seems to have stabilised since last Wednesday, with fundamental interest of gold traders being fixed on the Fed’s interest rate decision, something that we had noted in last week’s report as well. In this report we also examine whether the negative correlation of gold and the USD is active or not and we end the report with a technical analysis of gold’s daily chart for a rounder view.

- Starting with the negative correlation of the USD with gold’s price, we note that the opposite movement of the two trading instruments is rather blurred as both seem to have stabilised over the past few days. The USD over the past week, seemed to edge lower yet the bears are hesitant. The similar picture in reverse seems to apply for gold’s price, yet lack of a distinct direction tends to blur the picture as mentioned before. Similarly despite mixed directions from US bond yields the big picture is for the past week that US yields remained in relatively low levels which may be supportive for gold’s price given the antagonistic nature between gold and US bonds for safe haven investments. Should we see US Bond yields edging even lower we may see gold’s price enjoying more support and vice versa.

- On a monetary level, as mentioned we highlight the release of the Fed’s interest rate decision on Wednesday. The bank is widely expected to deliver a 25 basis points rate cut and currently Fed Fund Futures imply a probability of 97.3% for such a scenario to materialise, with the rest implying that a 50 basis points rate cut is also possible. Also, FFF imply that the market expects the bank to cut rates by 25 basis in the October as well as the December meetings, which could be translated as a clear dovish orientation on behalf of the market. Hence should the bank cut rates as expected, which is also our base scenario, the market’s attention may shift towards the bank’s forward guidance. The first element including forward guidance would be the bank’s forward guidance. Should the accompanying statement imply that the bank is ready to deliver more rate cuts until the end of the year, reaffirming the market’s dovish expectations we may see the gold’s price getting some support, while should the accompanying statement show hesitation on behalf of the bank to proceed with extensive rate cuts until the end of the year, we may see it weighing on gold’s price. The second element of interest would be the bank’s new dot plot. Should the new dot plot show that Fed policymakers are prepared to cut rates in alignment with the market’s dovish expectations, or even exceed them, we may see gold’s price getting some support, while a dot plot showing that Fed policymakers may cut only one more time until the end of the year could weigh on gold’s price. Finally we highlight Fed Chairman Powell’s press conference after the release of the Fed’s interest rate decision. Fed Chairman Powell is well known to be able to swing the market’s mood and should he sound dovish enough we may see gold’s price getting some support and vice versa. Also the bank’s projections about inflation, growth and the US employment market could affect gold’s price.

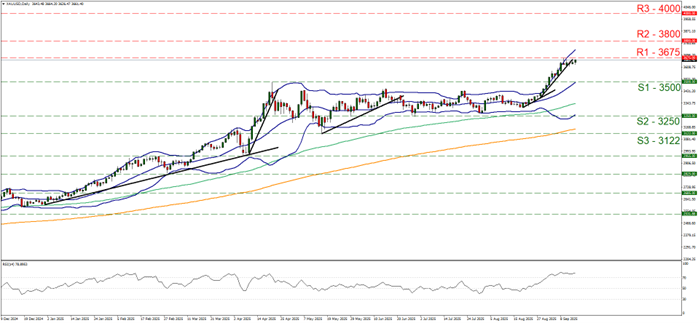

XAU/USD Daily Chart

- Support: 3500 (S1), 3250 (S2), 3122 (S3)

- Resistance: 3675 (R1), 3800 (R2), 4000 (R3)