Shares of Netflix slipped by over 6% in the aftermarket hours yesterday, as the company missed Wall Street analysts’ earnings estimates by a wide margin in the third quarter of 2025, but has, broadly speaking, achieved another strong quarter of growth.

More specifically the online streamer reported an adjusted EPS of $5.87, missing the $6.96 forecast, whereas its Revenue matched estimates, yielding $11.5 billion in Q3 of 2025, showcasing growth from last year but at the same time, worries for potential margin squeezes came to the forefront.

A tax dispute in Brazil hurt their solid quarterly results, the executives noted, as the government has recently ratified the rules around how international tech firms report and pay taxes on local ad revenue and streaming income, making them much stricter, causing a headache for the streamer.

Nevertheless, the company said membership growth, price hikes, and a booming ad tier helped revenue expand 17% year over year, as the world remains thirsty for entertainment content.

Squid game remains as the most watched show so far in 2025 on the streaming platform, whereas KPop Demon Hunters, an American animated fantasy film, is gaining a strong audience and could be the surprising star of the coming quarter.

Key takeaway is that the company’s ad-supported tier continues to grow, contributing more and more to revenue expansion. Tie that with an optimistic guidance for stronger demand from its users in the remainder of the year alongside the prospect for expansion of its membership base, the video streaming giant may swiftly recover from its recent fall and rise again near its record highs.

Also on the agenda of NFLX traders is the rumoured interest of the company to acquire Warner Bros Discovery, which announced plans to split into two separate entities by mid-2026 sighting openness for an acquisition and should the deal go through, Netflix may solidify its dominance in the media landscape.

Technical Analysis

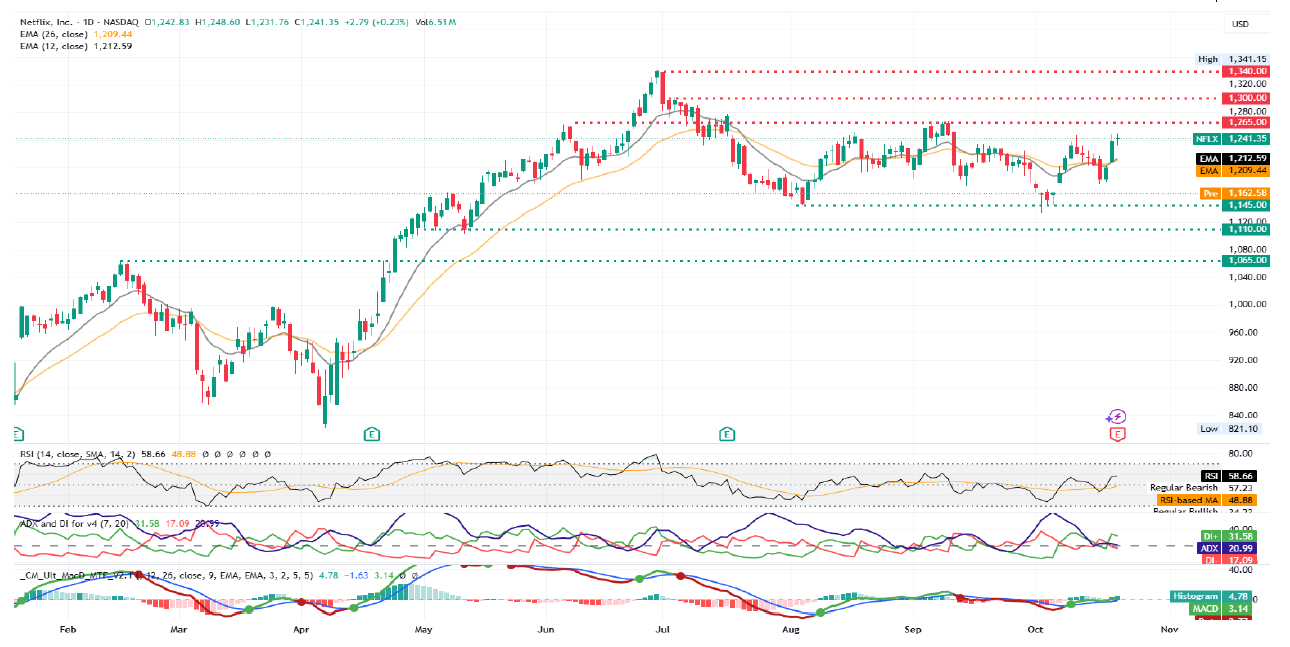

NFLX Chart – Netflix slips by over 6% in the aftermarket hours after disappointing investors with its EPS numbers

Resistance: 1265 (R1), 1300 (R2), 1340 (R3)

Support: 1145 (S1), 1110 (S2), 1065 (S3)