NVDIA earnings to update the trajectory of AI frenzy

Even though, detached-from-reality valuations and worries for a pop-up of the so-called AI bubble continue to permeate across equity markets, the AI powered rally is considered to be, amidst a mild, self-corrective cool-down phase by many investors currently. The bombastic AI innovation project is, and is expected to be, cap-ex intensive for the frontrunners in […]

Gold’s shine dampens after rate cut odds dwindle

Gold futures are currently experiencing four consecutive days of declines, as prospects for rate cuts from the world’s largest economy continue to face a watershed moment. Conviction for additional policy easing has drastically dwindled since the last Fed meeting, with half of polled economists altering their views and sidelining with a cautious, “wait and see” […]

Hawkish pivot from Fed officials spurs selling spree across riskier assets

A month ago, odds for a December rate cut from the Fed seemed inevitable. Market forecasters apprehended week after week, data that confirmed their biases, pushing them to overtly rely on the scenario for further easing. Equity indices were marching higher and higher, striking fresh record high after fresh record high as investors’ exuberance for […]

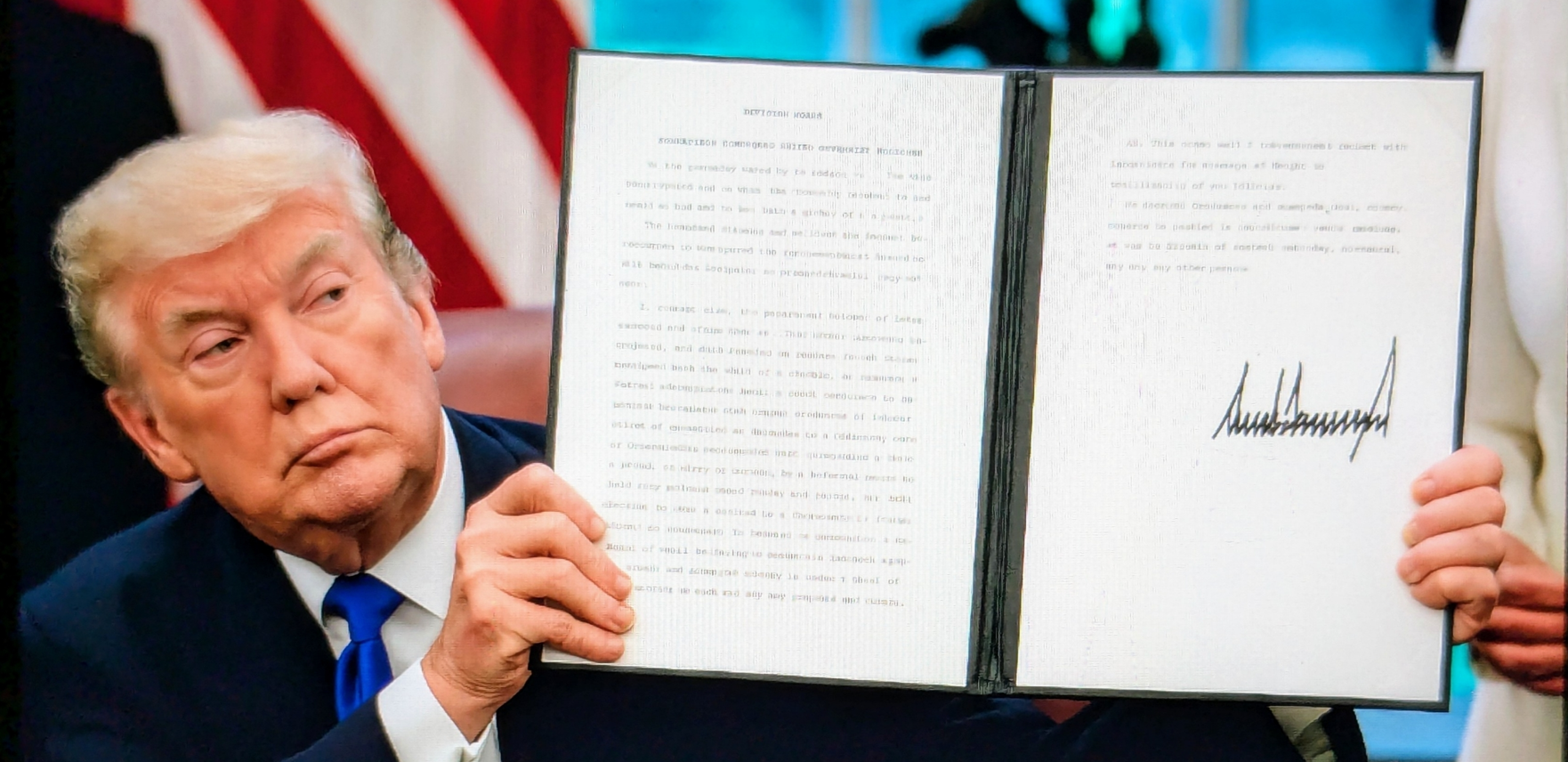

US government shutdown no more

With the signature of President Trump, the longstanding US government shutdown that began in early October 2025 has officially came to an end. The government funding bill was signed into law on November 11 of 2025, and set an end to the historic 43-day shutdown fiasco, after the House of Representatives approved the Senate-passed funding […]

A heads-up on this week’s releases

Given the absence of critical economic news releases today, we turn our attention towards the horizon and update our calendars with events that run the possibility of moving the markets this week: Tuesday: We kickstart the week with the UK’s employment update for the month of October, President Lagarde’s speech alongside Q3 earnings data from […]

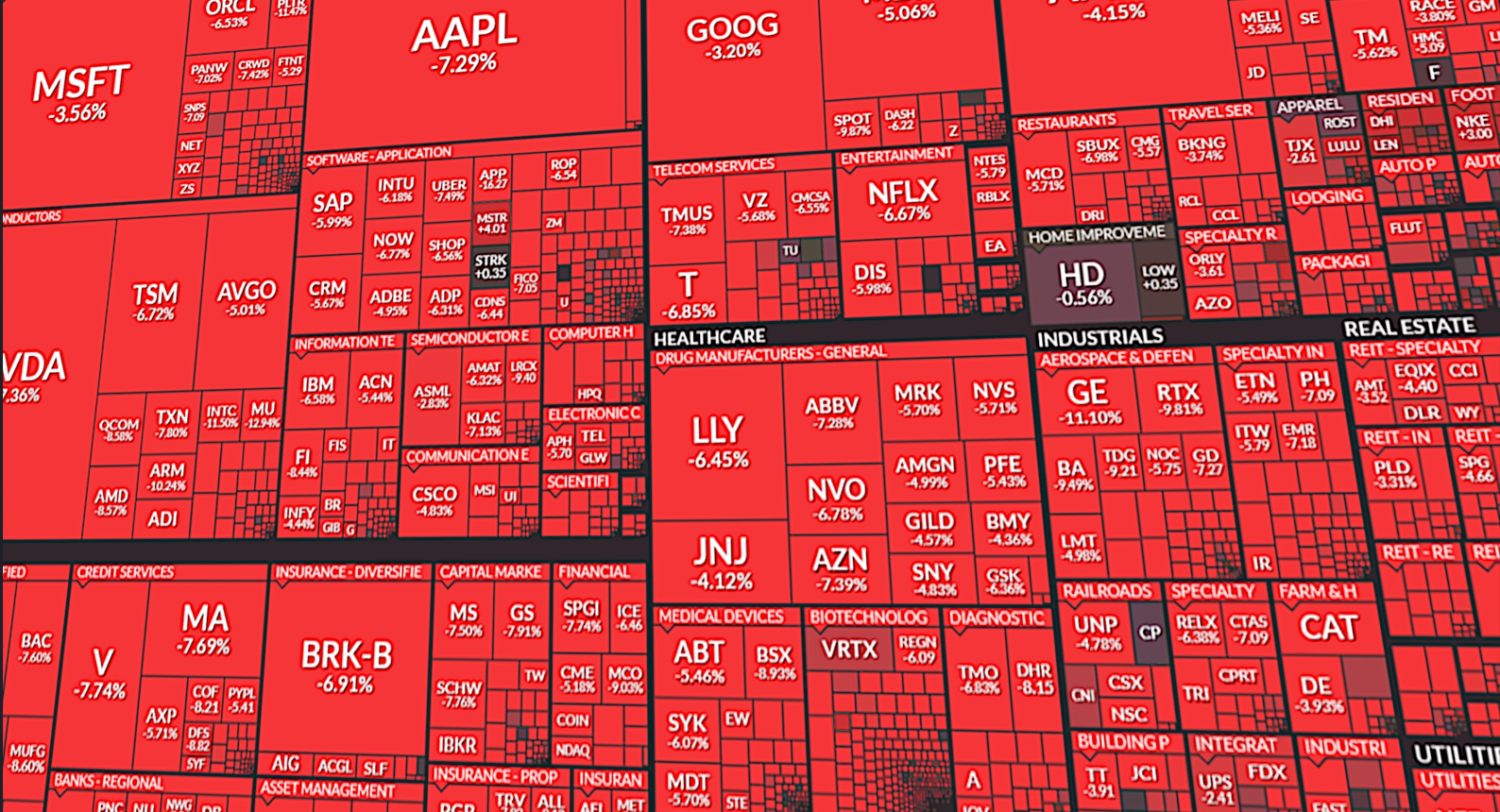

Overstretched tech valuations spark bubble-burst fears

All three major US equity indices sank yesterday from renewed fears that valuations of mega cap tech stocks have detached from reality and fundamentals. The sharp selloff on Wall Street was more prominent in Nasdaq Composite which tumbled 1.9% at the close, the S&P dripped 1.12% and Dow Jones by 0.84%. AI hyped plays such […]

Bank of England seen keeping rates steady at 4%

Anaemic economic growth and stagnant inflationary pressures in the UK will most likely incentivize BoE policy makers to keep policy rates intact for another meeting according to the majority of pollsters, projecting that the bank will await for additional data before unloading more easing measures. Softer data on inflation, growth and employment compared to August […]

Canary chirps in the coal mine? Fed quietly injects liquidity in banking sector

As investors get bombarded with earnings story after earnings story from top tech companies racing to get ahead in the AI race, behind the scenes and away from the spotlight, attracting virtually zero attention, the Federal Reserve quietly injected almost $30bn into the banking system, conducting its largest operation since 2020. The central bank quietly […]

Chancelor’s Reeves surprise speech

Two days ahead of the Bank of England’s rate decision, the UK’s Chancelor of Exchequer, Rachel Reeves, held an uncanny, surprise public announcement to inform British citizens about the Labour party’s fiscal plans, addressing the massive budget hole that she and her colleagues have to fill. Even though the Chancelor did not lay down concrete […]

Aussie traders await RBA’s next move

In tomorrow’s early Asian session, Aussie traders will fixate upon the Reserve Bank of Australia’s rate decision for their November meeting to gauge the direction of the Australian Dollar but also the Australian equity market, in the foreseeable future. Money markets project with a 95% certainty that RBA policymakers will go for a pause at […]

Amazon shares shoot up after blockbuster quarter

The world’s largest online retailer, Amazon, positively surprised Wall Street with its third quarter performance, driving its share price up by over 12% in the aftermarket hours and into uncharted all time high territory once again. Robust revenue growth across its core businesses, retail and cloud, toppled analysts’ lofty expectations and have also contributed positively […]

ECB seen standing still for the foreseeable future

Unlike the Federal Reserve yesterday, which extended its easing campaign by slashing another 25bps off its federal funds rate, the European Central Bank is widely expected to stand pat and hold rates steady for a third consecutive meeting. Fore reference, the main refinancing rate is set to remain at 2.15%, while the deposit facility rate […]

Fed to deliver policy decision without updated data

The main attraction of the week is bound to be the monetary policy decision from the Federal Reserve later on today, which will steer the direction of rates amidst a period of scarce economic data due to an ongoing US government shutdown. Policymakers have been flying blind over the past month or so, as the […]

Policy decisions, Mag 7 earnings and crucial econ data ahead

Given the lack of economic news releases today Monday, we decided to outline the most important and crucial events scattered across this week on the economic, policy and earnings fronts: Tuesday: We begin with the BoJ Core CPI print in the early Asian session and the CB consumer confidence indicator for the month of October […]

Focus returns on economic data after blackout period

Even though the US government shutdown is still underway, marking 22 consecutive days without the passage of legislative funding for financing the federal government, market participants rejoice as they will apprehend the first crucial piece of economic data and draw their best conclusions, as to how the Federal Reserve will proceed in its upcoming policy […]

The West’s united pressure-measures against Russian energy giants

Crude oil futures are on track to sustain the headway made in the prior two sessions and rebound further from 4- month lows, as the United States ramped up efforts to restrict flows of cheap Russian oil in energy markets. Washington’s renewed sanctions package now includes Lukoil and Rosneft, two of Russia’s largest energy players […]

Earnings miss drags Netflix lower

Shares of Netflix slipped by over 6% in the aftermarket hours yesterday, as the company missed Wall Street analysts’ earnings estimates by a wide margin in the third quarter of 2025, but has, broadly speaking, achieved another strong quarter of growth. More specifically the online streamer reported an adjusted EPS of $5.87, missing the $6.96 […]

Safe haven assets slide on enhanced profit-taking activity

Both gold and silver futures have experienced declines, detaching from their respective record highs as investors capitalized on the overextension by taking profits. Silver has already shed 5% of its value within the past three sessions and today is down by almost another 5%, trending near the $50 per ounce level, whereas gold managed so […]

CCP to announce its fourth plenum goals

In the Great Hall of the People, the Central Committee of the Chinese communist party has set in motion the most important, four-day, political meeting of the year, dubbed the plenum, discussing and unravelling how strategic policy decisions will steer the nation’s development in the next five years. A draft of the next five-year plan, […]

Anxiousness over credit weighs on Wall Street

All three major US stock market indices steadily shed their early premarket gains yesterday and closed the session in the reds after two US regional banks disclosed loan problems involving alleged fraud, bolstering fears of broader credit market stress. Losses continue to roll in during today’s premarket session, with market participants reacting swiftly, almost identically, […]