Gold’s Weekly Update: Gold’s bullish tendencies cancelled for now

Since last week’s update, gold’s price rose but corrected lower again, surrendering the majority of the gains made. In today’s report we are to examine the validity of the negative correlation of the USD with gold’s price, have a look at how US bond yields have behaved and also make a comment about the Fed’s […]

India Trade Deficit Government registered at $41.68B above expectations ($29.4B) in October

India Trade Deficit Government registered at $41.68B above expectations ($29.4B) in October

Gold Price Forecast: XAU/USD is looking for direction right below $4,100

Gold’s (XAU/USD) reversal from monthly highs near $4,250 hit last week has been contained above $4,040, but the precious metal is trading sideways on Monday with upside attempts capped below the $4,100 so far.

EUR/JPY consolidates as Yen benefits from GDP data, Euro aided by growth revision

EUR/JPY trades around 179.60 on Monday at the time of writing, virtually unchanged on the day after pulling back from last week’s multi-year high near 180.00.

EUR/USD: Likely to trade between 1.1595 and 1.1645 – UOB Group

The current price movements are likely part of a range-trading phase between 1.1595 and 1.1645.

GBP: Wild ride on the day – ING

It has been quite easy to lose track of the UK government’s messaging regarding November’s budget, ING’s FX analyst Chris Turner notes.

DXY: Supported by caution – OCBC

DXY was a touch firmer this morning. Market narrative has shifted towards concerns of what the backlog of US data may reveal about the US economy but at the same time, there is also rising caution that Fed may slow pace of rate cuts.

Oil: Novorossiysk resumes Oil shipments – ING

ICE Brent settled almost 1.2% higher last week after a Friday rally following a Ukrainian attack on the Russian port of Novorossiysk.

EUR: European Commission autumn forecasts in focus – ING

In focus on a quiet Monday will be the European Commission’s autumn forecasts. In spring, the EC downgraded the 2025 and 2026 euro area GDP forecasts to 0.9% and 1.4% respectively, with inflation at 2.5% and 1.7%.

Hawkish pivot from Fed officials spurs selling spree across riskier assets

A month ago, odds for a December rate cut from the Fed seemed inevitable. Market forecasters apprehended week after week, data that confirmed their biases, pushing them to overtly rely on the scenario for further easing. Equity indices were marching higher and higher, striking fresh record high after fresh record high as investors’ exuberance for […]

Oil Weekly Update: Oversupply fears resurface after IEA’s forecasts

Technical Analysis of Oil WTI Chart – Crude futures remain rangebound near the $59 per barrel area due to absence of volatility Crude futures remained confined, since last week, between the $61.50 (R1) and $58.00 (S1) levels this week and yesterday signs of strength from the bears were observed, possibly foretelling that a move towards […]

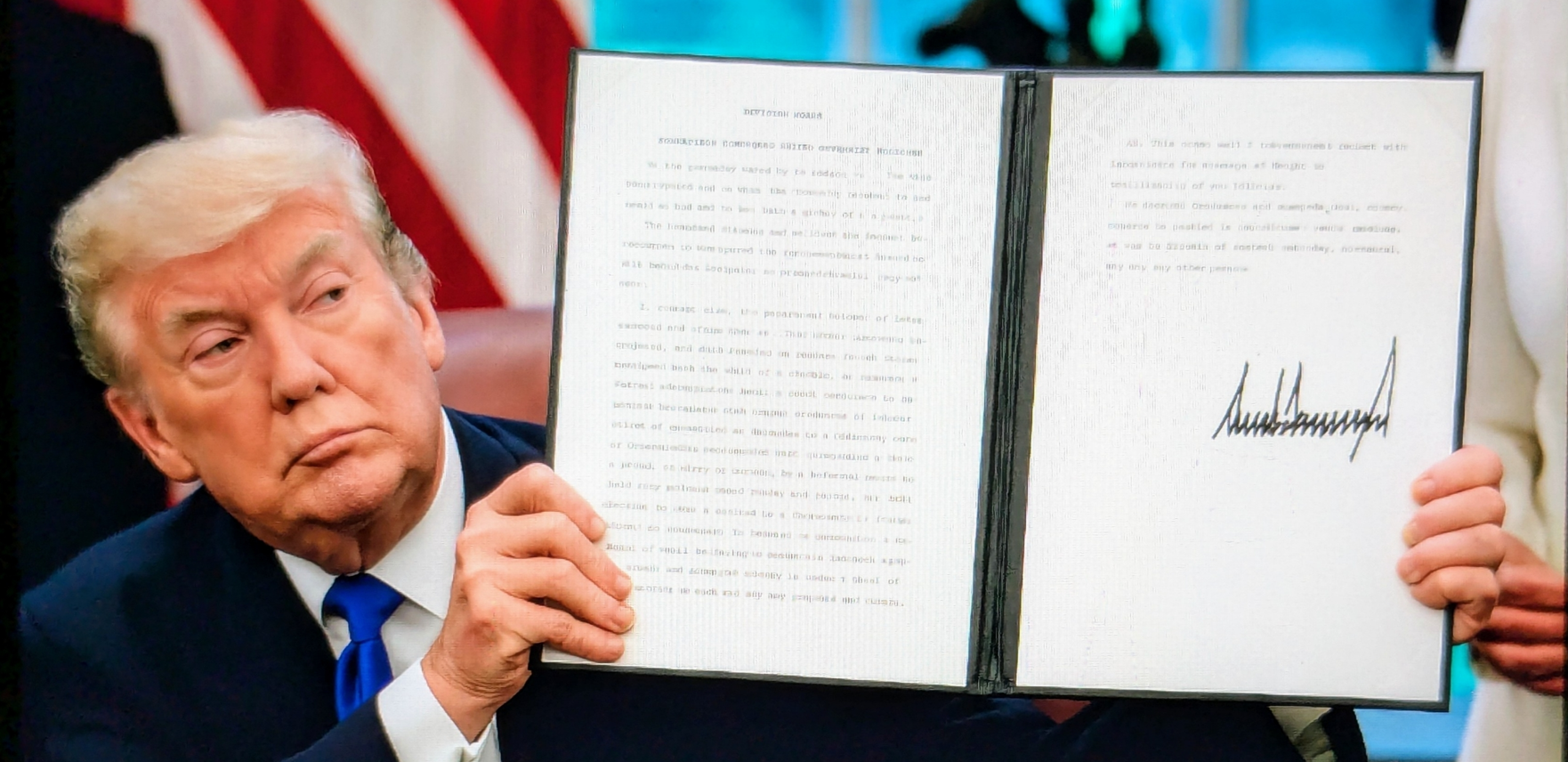

US government shutdown no more

With the signature of President Trump, the longstanding US government shutdown that began in early October 2025 has officially came to an end. The government funding bill was signed into law on November 11 of 2025, and set an end to the historic 43-day shutdown fiasco, after the House of Representatives approved the Senate-passed funding […]

ECB’s Vujčić: Market valuations are stretched

European Central Bank (ECB) policymaker Boris Vujčić said on Tuesday that risks are balanced around inflation, per Reuters.

EUR/JPY Price Forecast: Targets fresh record highs near 179.00 as bullish bias prevails

EUR/JPY extends its gains for the third consecutive session, trading around 178.40 during the European hours on Tuesday. The currency cross shows strong short-term momentum, trading above the nine-day Exponential Moving Average (EMA).

USD: Interest rate decisions in uncertain times – Commerzbank

While the financial markets were almost in a ‘celebratory mood’ in view of the looming end of the US government shutdown, EUR/USD remained flat yesterday. The price moved within a narrow range around the 1.1550 mark.

Gold sticks to gains near three-week high as Fed rate cut bets offset modest USD uptick

Gold (XAU/USD) sticks to modest intraday gains through the first half of the European session and currently trades just below a nearly three-week high touched this Tuesday.

Gold’s Weekly Update: Gold’s bullish tendencies are renewed

Since our last outlook, gold’s price remained relatively stable until todays’ opening in the Asian session, as the precious metal’s price rallied. In today’s report we are to discuss fundamental issues affecting currently gold’s price. For a rounder view, we are also to provide a technical analysis of gold’s daily chart. Gold Technical analysis Gold’s […]

A heads-up on this week’s releases

Given the absence of critical economic news releases today, we turn our attention towards the horizon and update our calendars with events that run the possibility of moving the markets this week: Tuesday: We kickstart the week with the UK’s employment update for the month of October, President Lagarde’s speech alongside Q3 earnings data from […]

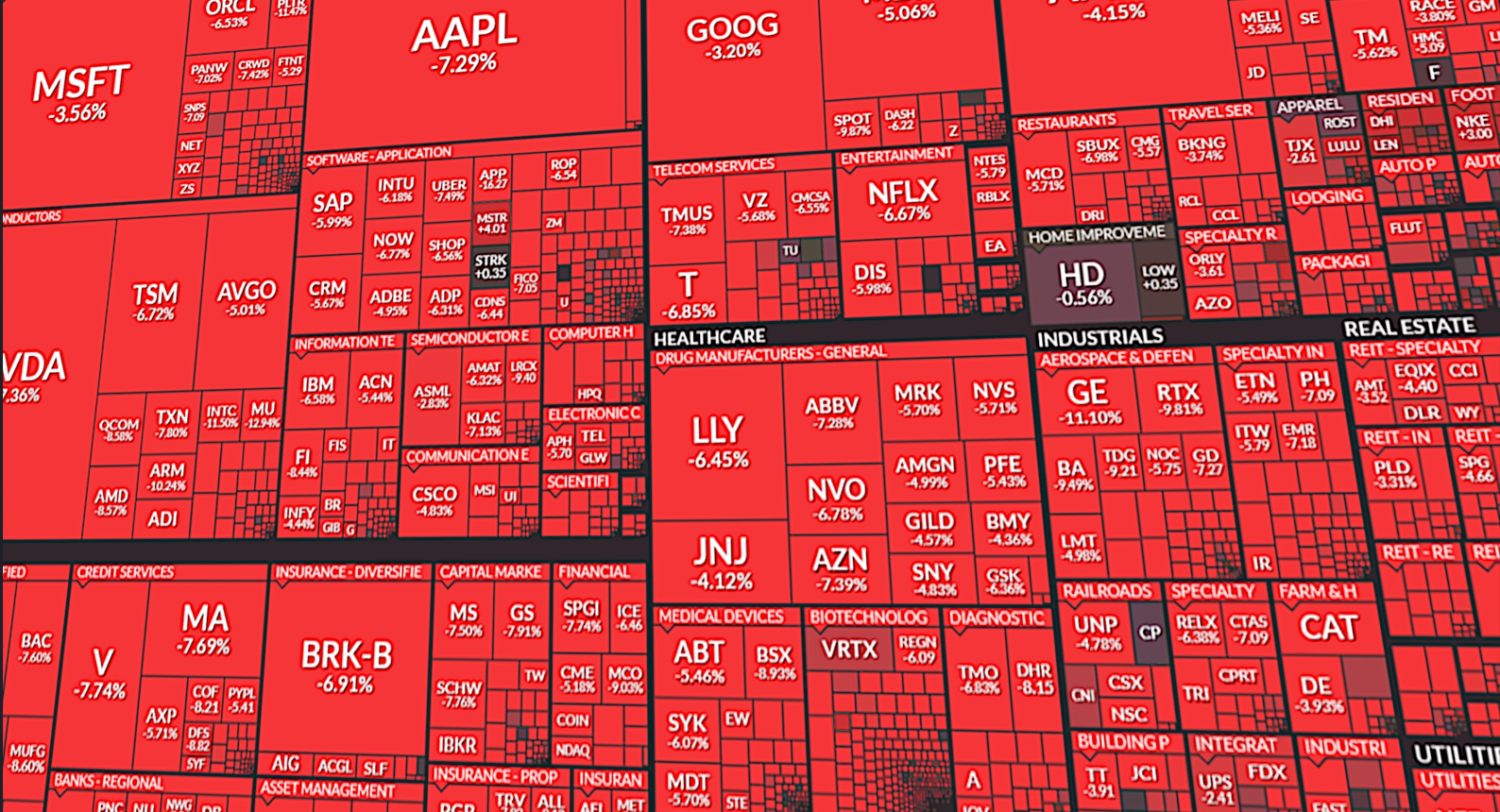

Overstretched tech valuations spark bubble-burst fears

All three major US equity indices sank yesterday from renewed fears that valuations of mega cap tech stocks have detached from reality and fundamentals. The sharp selloff on Wall Street was more prominent in Nasdaq Composite which tumbled 1.9% at the close, the S&P dripped 1.12% and Dow Jones by 0.84%. AI hyped plays such […]

Crude Oil (WTI) below $60 per barrel after failed charge to higher ground

Technical Analysis of Oil WTI Chart – In the absence of volatility, crude futures gradually erase the swift gains made in prior 2 weeks After failing to extend their rally above the $61 per barrel area crude due to weak buying activity, futures gradually returned to their former consolidation zone, trading between the $60.50 (R1) […]