EUR: European Commission autumn forecasts in focus – ING

In focus on a quiet Monday will be the European Commission’s autumn forecasts. In spring, the EC downgraded the 2025 and 2026 euro area GDP forecasts to 0.9% and 1.4% respectively, with inflation at 2.5% and 1.7%.

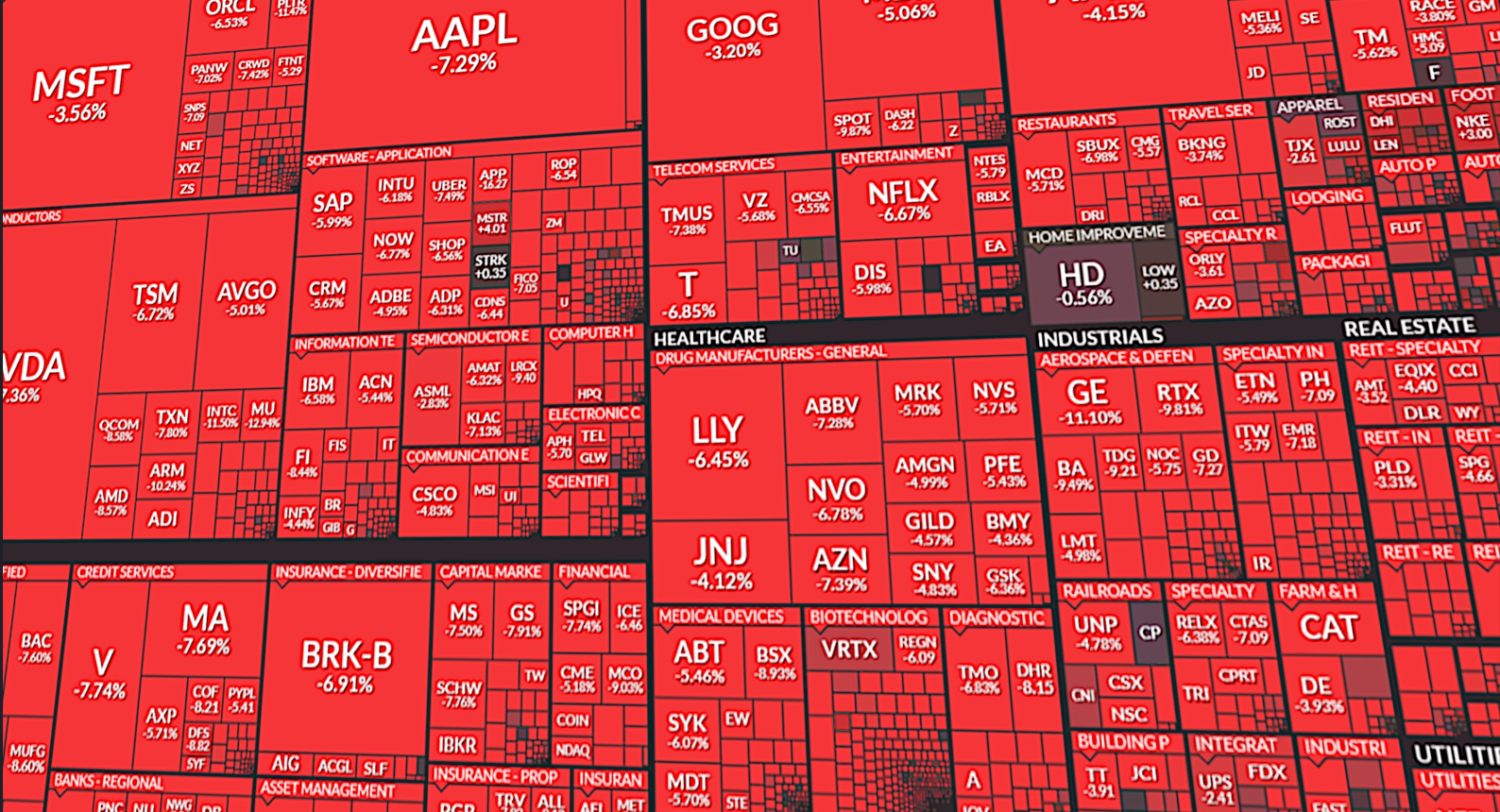

Hawkish pivot from Fed officials spurs selling spree across riskier assets

A month ago, odds for a December rate cut from the Fed seemed inevitable. Market forecasters apprehended week after week, data that confirmed their biases, pushing them to overtly rely on the scenario for further easing. Equity indices were marching higher and higher, striking fresh record high after fresh record high as investors’ exuberance for […]

Oil Weekly Update: Oversupply fears resurface after IEA’s forecasts

Technical Analysis of Oil WTI Chart – Crude futures remain rangebound near the $59 per barrel area due to absence of volatility Crude futures remained confined, since last week, between the $61.50 (R1) and $58.00 (S1) levels this week and yesterday signs of strength from the bears were observed, possibly foretelling that a move towards […]

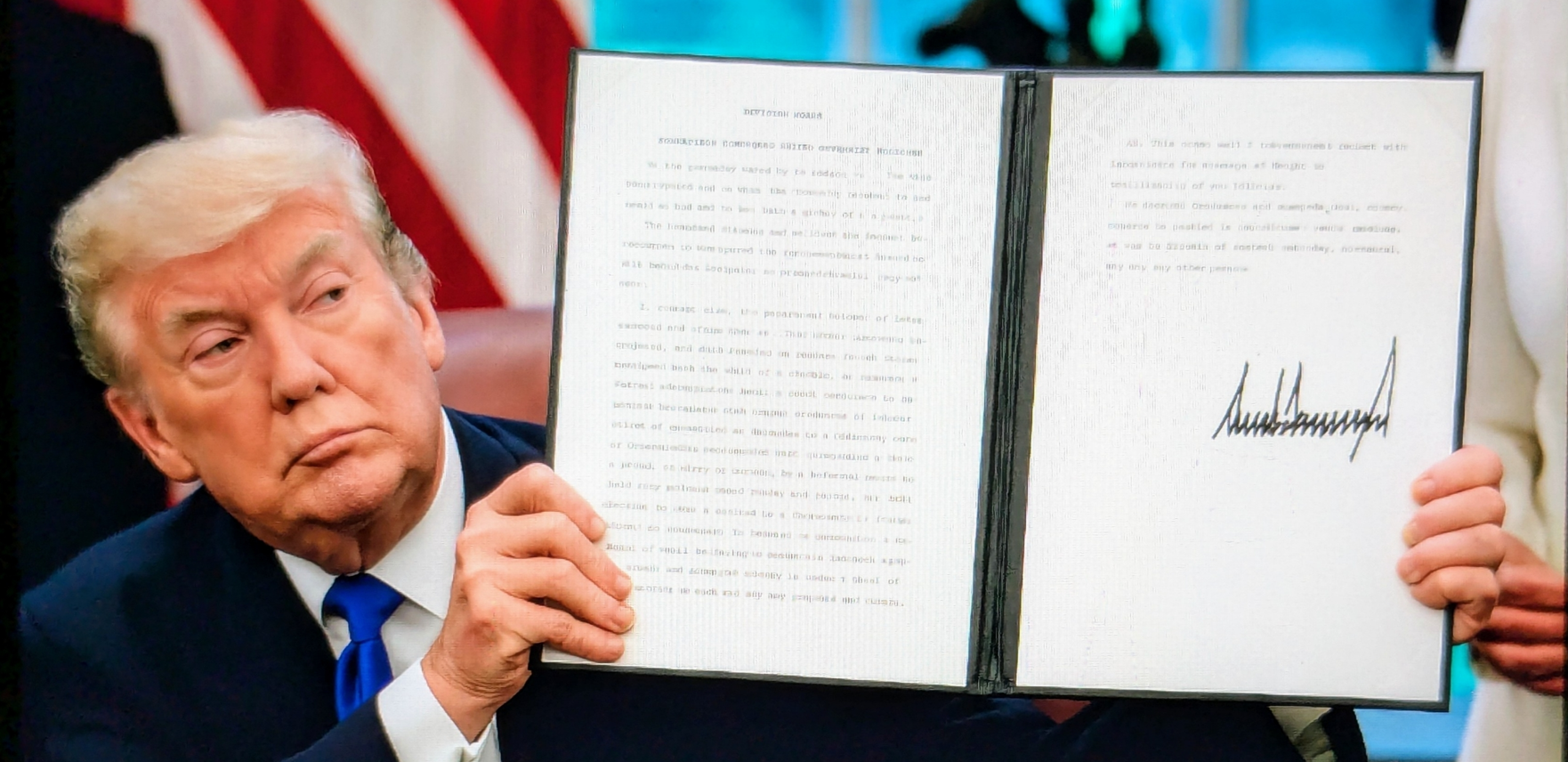

US government shutdown no more

With the signature of President Trump, the longstanding US government shutdown that began in early October 2025 has officially came to an end. The government funding bill was signed into law on November 11 of 2025, and set an end to the historic 43-day shutdown fiasco, after the House of Representatives approved the Senate-passed funding […]

ECB’s Vujčić: Market valuations are stretched

European Central Bank (ECB) policymaker Boris Vujčić said on Tuesday that risks are balanced around inflation, per Reuters.

EUR/JPY Price Forecast: Targets fresh record highs near 179.00 as bullish bias prevails

EUR/JPY extends its gains for the third consecutive session, trading around 178.40 during the European hours on Tuesday. The currency cross shows strong short-term momentum, trading above the nine-day Exponential Moving Average (EMA).

USD: Interest rate decisions in uncertain times – Commerzbank

While the financial markets were almost in a ‘celebratory mood’ in view of the looming end of the US government shutdown, EUR/USD remained flat yesterday. The price moved within a narrow range around the 1.1550 mark.

Gold sticks to gains near three-week high as Fed rate cut bets offset modest USD uptick

Gold (XAU/USD) sticks to modest intraday gains through the first half of the European session and currently trades just below a nearly three-week high touched this Tuesday.

Gold’s Weekly Update: Gold’s bullish tendencies are renewed

Since our last outlook, gold’s price remained relatively stable until todays’ opening in the Asian session, as the precious metal’s price rallied. In today’s report we are to discuss fundamental issues affecting currently gold’s price. For a rounder view, we are also to provide a technical analysis of gold’s daily chart. Gold Technical analysis Gold’s […]

A heads-up on this week’s releases

Given the absence of critical economic news releases today, we turn our attention towards the horizon and update our calendars with events that run the possibility of moving the markets this week: Tuesday: We kickstart the week with the UK’s employment update for the month of October, President Lagarde’s speech alongside Q3 earnings data from […]

Overstretched tech valuations spark bubble-burst fears

All three major US equity indices sank yesterday from renewed fears that valuations of mega cap tech stocks have detached from reality and fundamentals. The sharp selloff on Wall Street was more prominent in Nasdaq Composite which tumbled 1.9% at the close, the S&P dripped 1.12% and Dow Jones by 0.84%. AI hyped plays such […]

Crude Oil (WTI) below $60 per barrel after failed charge to higher ground

Technical Analysis of Oil WTI Chart – In the absence of volatility, crude futures gradually erase the swift gains made in prior 2 weeks After failing to extend their rally above the $61 per barrel area crude due to weak buying activity, futures gradually returned to their former consolidation zone, trading between the $60.50 (R1) […]

Bank of England seen keeping rates steady at 4%

Anaemic economic growth and stagnant inflationary pressures in the UK will most likely incentivize BoE policy makers to keep policy rates intact for another meeting according to the majority of pollsters, projecting that the bank will await for additional data before unloading more easing measures. Softer data on inflation, growth and employment compared to August […]

Canary chirps in the coal mine? Fed quietly injects liquidity in banking sector

As investors get bombarded with earnings story after earnings story from top tech companies racing to get ahead in the AI race, behind the scenes and away from the spotlight, attracting virtually zero attention, the Federal Reserve quietly injected almost $30bn into the banking system, conducting its largest operation since 2020. The central bank quietly […]

Chancelor’s Reeves surprise speech

Two days ahead of the Bank of England’s rate decision, the UK’s Chancelor of Exchequer, Rachel Reeves, held an uncanny, surprise public announcement to inform British citizens about the Labour party’s fiscal plans, addressing the massive budget hole that she and her colleagues have to fill. Even though the Chancelor did not lay down concrete […]

PBOC sets USD/CNY reference rate at 7.0885 vs. 7.0867 previous

The People’s Bank of China (PBOC) set the USD/CNY central rate for the trading session ahead on Tuesday at 7.0885 compared to the previous day’s fix of 7.0867 and 7.1226 Reuters estimate.

NZD/USD extends the decline below 0.5700 on downbeat Chinese PMI data, Fed’s hawkish remarks

The NZD/USD pair attracts some sellers to around 0.5695 during the early Asian session on Tuesday. The New Zealand Dollar (NZD) weakens against the US Dollar (USD) as the latest data showed the Chinese manufacturing sector weakening last month.

Japan Jibun Bank Manufacturing PMI came in at 48.2, below expectations (48.3) in October

Japan Jibun Bank Manufacturing PMI came in at 48.2, below expectations (48.3) in October

Gold Price Forecast: XAU/USD holds below $4,000 as Fed’s hawkish remarks lift US Dollar

Gold price (XAU/USD) declines to around $4,000 during the early Asian session on Tuesday. The precious metal edges lower as traders dialed back bets for further Federal Reserve (Fed) rate cuts. The Fed’s Michelle Bowman is scheduled to speak later in the day.

Gold’s Weekly Update: Gold stabilises after correcting lower

Since our last report, Gold’s price tended to stabilise after correcting lower and market worries are as to where gold’s price is heading to. In the current report we are to review fundamentals which tend to tantalise the gold market at the current stage. For a rounder view we are also to provide a technical […]