Given the absence of critical economic news releases today, we turn our attention towards the horizon and update our calendars with events that run the possibility of moving the markets this week:

Tuesday: We kickstart the week with the UK’s employment update for the month of October, President Lagarde’s speech alongside Q3 earnings data from Softbank, Nebius and Vodafone.

Wednesday: We note Germany’s finalized HICP for October, EIA’s short term energy outlook and OPEC’s monthly reports. We also note the earnings updates from Cisco, Infineon and Circle Internet.

Thursday: We begin early in the Asian session, with Australia’s employment report for October, the UK’s preliminary GDP print for Q3 of 2025 and the main event of the week, which is the inflation update from the United States for the month of October. On the earnings front we highlight the releases from Tencent, Alibaba, Siemens, Walt Disney and Applied Materials.

Friday: Finally, Friday we close the show with China’s industrial production and fixed asset investment updates, early in the Asian session, Eurozone’s preliminary GDP print for the third quarter of 2025 and earnings calls from MUFG, Allianz and Mizuho

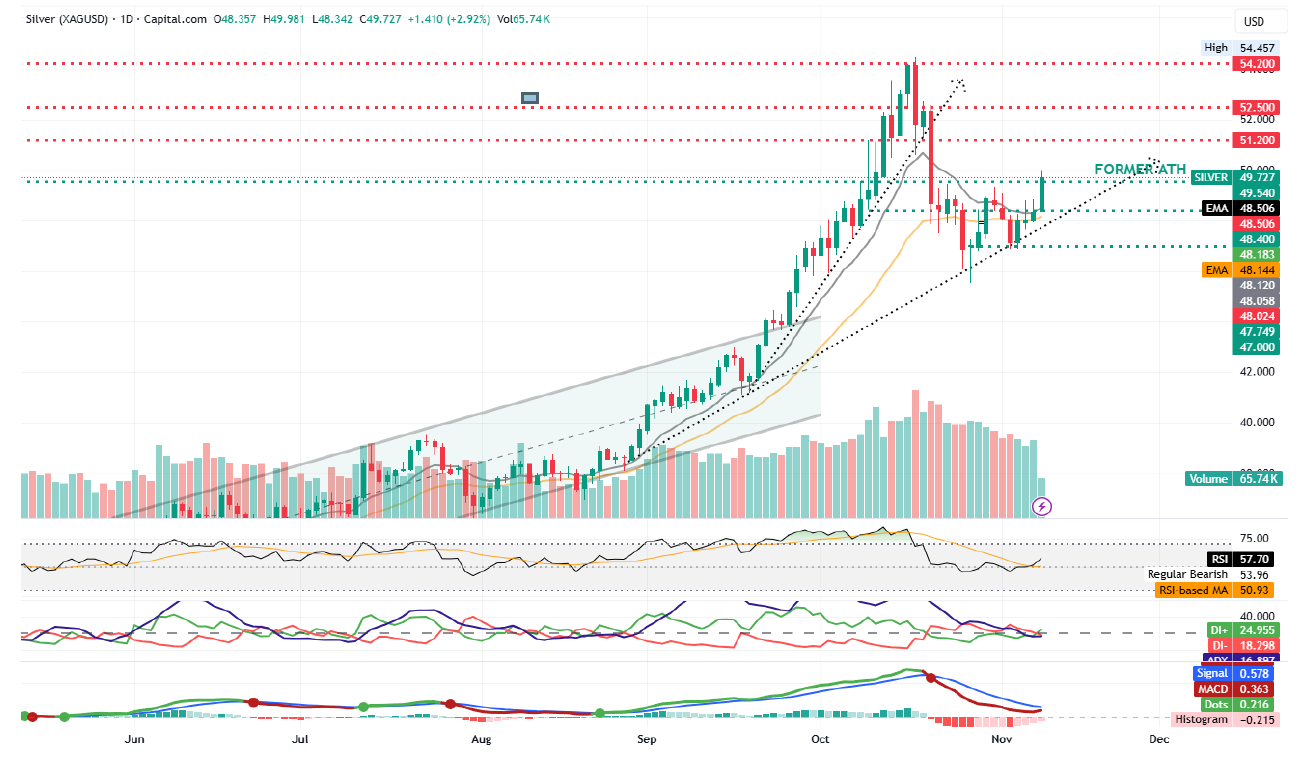

Technical Analysis

XAGUSD Chart Silver futures jump after Trump teases end of US government shutdown

Resistance: 51.20 (R1), 52.50 (R2), 54.20 (R3)

Support: 49.54 (S1), 48.40 (S2), 47.00 (S3)