As we veer closer to Trump’s August 1st deadline, markets to their surprise, do not, repeatedly encounter signs of blatant acts of trade aggression, as they once feared, but rather necessary compromises or inevitable retreats, which nevertheless tame worries.

The case can thus be made for the US preliminarily “winning” the trade wars and achieving its goals by reinstating fairer, reciprocal trade conditions on its enemies, projecting strength, but risking at the same time, disenchanting and disenfranchising its longstanding allies, by conscientiously opting for the isolationist approach.

Given that deals have been reached with EU, Japan, the UK and China (second round of negotiations is underway in Sweden) and volatility dwindled, markets now shift their attention back on traditional economic news releases to gauge the trajectory, of not only the greenback but also equities and precious metals.

The main attraction for the week is ought to be the Federal Reserve’s rate decision for July, were markets will fixate upon the central bank’s forward guidance and the speech from Fed Chair Powel, who came under Trump’s fire late last week at the institutions renovation “inspections”. Money markets expect yet another pause of the policy rate at the 4.25% level and debate rages on of whether one or two cuts will follow through the rest of the year.

Another equally important event is scheduled for Friday, the 1st of August, and its none other than the payrolls data for July. The Non-Farm Payrolls data will showcase whether the labour market remains robust and thus than snapshot would force the Fed to slash rates or keep its hands tight until further notice.

Lastly, a plethora of big tech earnings arrive mid-week, with heavyweights such as Microsoft, Apple, Meta Platforms and Amazon providing an update of their Q2 performance, either derailing or sustaining the rally in equity markets.

Technical Analysis

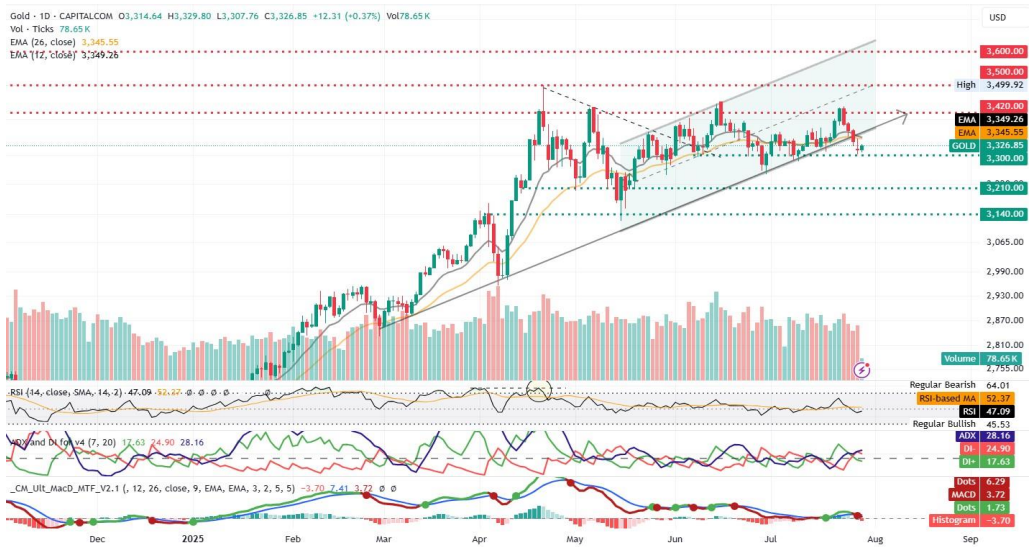

XAUUSD Chart – The bullion’s shine dampens as volatility dissipates, after US reaches multiple trade deals before August 1st deadline

Resistance: 3420 (R1), 3500 (R2), 3600 (R3)

Support: 3300 (S1), 3210 (S2), 3140 (S3)